Shift in focus in the Indian Art Market

Market Insight

by AAMRA

The Art Tactic Indian Art Market Confidence Indicator (May 2011) has recently been published and the overall results are quite encouraging. At a glance, this is what it offers:

The Art Tactic Indian Art Market Confidence Indicator is up by 19.2% from October 2010, helped by a strong confidence in the Indian economy. The Art Tactic Confidence Indicator for the Modern Indian art market increases by 10.5% as collectors continue to focus on the more established Modern market.

For the first time since October 2008,  the Art Tactic Confidence Indicator for the Contemporary Indian art market is finding itself in positive territory. After dropping 10.8% between May 2010 and October 2010, the Contemporary Indicator saw a healthy increase of 30.1%. Fear of rising speculation in the Modern Indian market drops by 24.1% as market growth slows down.

the Art Tactic Confidence Indicator for the Contemporary Indian art market is finding itself in positive territory. After dropping 10.8% between May 2010 and October 2010, the Contemporary Indicator saw a healthy increase of 30.1%. Fear of rising speculation in the Modern Indian market drops by 24.1% as market growth slows down.

53% of the respondents believe the Modern Indian art market has already rebounded, but 44% of the experts believe the Modern market will take 1year or more to fully recover, compared to 14% of the experts in October 2010. 44% of the experts believe the Modern Indian market will go up in the next 6 months, with 55% of the respondents believing the market will remain flat.

Despite the increase in positive sentiment in the Indian Contemporary art market, full recovery seem to be some time away – with 55% of the experts believing the contemporary market recovery will take 3 years or more, compared to 21% of the experts in October 2010. 24% of the experts believe the Contemporary Indian market will go up in the next 6 months, versus a majority of 55% who believe it will remain flat. 20% of the experts believe the market could fall in the next 6 months.

Even towards the beginning of this year, experts feared that the modern and contemporary Indian art market was becoming more and more speculative. However the low and medium performances of contemporary Indian art at auction houses over the first quarter of 2011 was reason enough to drive away these small time punters. Besides, there is another reason behind the recovery of the modern and contemporary Indian art market from the clutches of short-term risk takers or 'punters' as they are colloquially called. The action, according to Art Tactic is gradually shifting from auction houses to gallery floors, private sales and dealers.

According to Art Tactic, “Whilst the Indian auction market has been a bellwether for the overall Indian art market, it is becoming evident that the current market activity is happening elsewhere, such as in the gallery, dealer and private sales market. The increasing popularity of art fairs, such as the India Art Summit (now the India Art Fair) – is a sign that the Indian art market is maturing,  and that the confidence in buying art outside the auction room is on the increase.”

and that the confidence in buying art outside the auction room is on the increase.”

What this means is that the profits are percolating right up to individuals who are responsible for the art being produced. It also means that more and more buyers are getting a better deal and being able to decide on their own about exactly which piece of art they want to invest upon, without being swayed by the age-old auction-floor tactics of competitive bidding that actually influences on-floor buyer sentiments, which ultimately may not do much justice to the original piece of art on sale.

The trend also means the primary market is slowly gaining in importance as compared to secondary of subsequent markets. For a developing nation, this is very significant. It proves that a part of the money coming into the burgeoning economy that India is, and promises to be at least in the near future, is being pumped into an exotic investment like art. This is exactly what happened when China took the first steps towards becoming one of the strongest players of the global art market.

And the focus of the market shifting from auction floors to gallery floors, studio floors and dealer shops points towards another aspect of the art market that of the emerging indigenous buyer. Although this is in direct conflict with a recent Reuters report which went on to establish that the top segment of Indian society has still a long way to go in becoming inclined towards exotic investments like art, rather preferring brick-and-mortar investments like real estate, gold or the stock market, this is the only conclusion that can be drawn from what Art Tactic goes on to state.

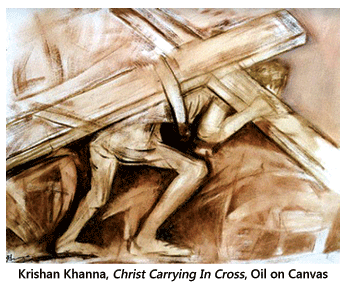

At this point, it will not be out of place to discuss a few artists and their performance trends according to the same report of Art Tactic. Art Tactic lists Jogen Chowdhury and Himmat Shah as under-performers who are, as far as price is concerned on a positive trend in between October 10 and May 11. Out of them, Chowdhury, as per current performance trend has the capacity to graduate to a long-term performer although Himmat Shah may only graduate towards a short-term performance matrix. Krishen Khanna however has a negative trend during the same period. K G Subhramanyam, though a short term performer during the same period is fast graduating towards being a long-term performer. The leaders remain the same. Husain, Tyeb Mehta, V. S. Gaitonde, S. H. Raza, Ram Kumar and Arpita Singh. Long term performers who, according to Art Tactic have reached a trough are Bhupen Khakhar, F. N. Souza, Jagdish Swaminathan, Nasreen Mohammed and Zarina Hashmi. However, there is cause for concern for Akbar Padamsee and Rameshwar Broota, who have been short term performers, but are fast moving in the direction of being under-performers. The story of Krishen Khanna is the saddesthe is not only an under performer, but is also showing a negative trend between October 10 and May 11.

Out of them, Chowdhury, as per current performance trend has the capacity to graduate to a long-term performer although Himmat Shah may only graduate towards a short-term performance matrix. Krishen Khanna however has a negative trend during the same period. K G Subhramanyam, though a short term performer during the same period is fast graduating towards being a long-term performer. The leaders remain the same. Husain, Tyeb Mehta, V. S. Gaitonde, S. H. Raza, Ram Kumar and Arpita Singh. Long term performers who, according to Art Tactic have reached a trough are Bhupen Khakhar, F. N. Souza, Jagdish Swaminathan, Nasreen Mohammed and Zarina Hashmi. However, there is cause for concern for Akbar Padamsee and Rameshwar Broota, who have been short term performers, but are fast moving in the direction of being under-performers. The story of Krishen Khanna is the saddesthe is not only an under performer, but is also showing a negative trend between October 10 and May 11.

This is a pretty illustrative example of the facts discussed above. Souza, Kakkar, Swaminathan, while remaining long-term performers yet reaching a trough goes on to prove that the auction market, which until recently, has held sway over the Indian art market, is not that influential any more. Similarly Akbar Padamsee and Rameshwar Broota's negative pricing trend also goes on to prove that the ill-effects of auction pricing are on a dwindle.

The cause for concern in this Art Tactic graph is that it shows no body in the future performers section. However, it must be remembered that the Art Tactic graph is largely conservative. What it notes before the graph is what is important. The market is moving towards studio-floors. That surely holds promise for the new breed of Indian artists.

Tags: art